Chase Mortgage Loan Statement: A Comprehensive Guide To Understanding Your Financial Position

Looking for clarity on your Chase mortgage loan statement? You're not alone. Many homeowners find themselves scratching their heads when it comes to deciphering the intricacies of mortgage statements. Whether you're a first-time homebuyer or a seasoned property owner, understanding your Chase mortgage loan statement is key to managing your finances effectively.

Let’s face it, buying a home is one of the biggest financial decisions you'll ever make. And with that comes the responsibility of keeping track of your mortgage payments, interest rates, and other financial details. That’s where your Chase mortgage loan statement comes in. It’s like a roadmap to your financial journey, helping you stay on track and make informed decisions.

In this guide, we’ll break down everything you need to know about your Chase mortgage loan statement. From understanding the key components to uncovering hidden fees, we’ve got you covered. So, grab a cup of coffee, sit back, and let’s dive into the world of mortgage statements together.

- Bryant Reeves Net Worth Unveiling The Wealth Behind The Iconic Wrestler

- Ralph Bernstein The Man Who Left A Legacy In The World Of Business And Leadership

What Exactly is a Chase Mortgage Loan Statement?

A Chase mortgage loan statement is more than just a piece of paper or an email in your inbox. It’s essentially a detailed report that outlines your mortgage payment activity for a specific period, usually monthly. Think of it as a snapshot of your financial relationship with Chase when it comes to your home loan.

This statement includes critical information such as your payment history, outstanding balance, interest rates, escrow details, and more. It’s like having a personal financial advisor in your pocket, helping you stay organized and aware of your financial obligations.

Why is Understanding Your Chase Mortgage Loan Statement Important?

Understanding your Chase mortgage loan statement isn’t just about knowing how much you owe; it’s about taking control of your financial future. Here are a few reasons why it’s crucial:

- Who Really Owns General Motors A Deep Dive Into The Gm Ownership Structure

- Taylor Swift And Jake Gyllenhaal The Ultimate Love Story That Made Headlines

- Transparency: It provides a clear picture of where your money is going.

- Planning: Helps you plan your finances better by showing payment trends.

- Error Detection: Allows you to spot any discrepancies or errors in your payments.

- Peace of Mind: Keeps you informed, reducing stress and uncertainty about your mortgage.

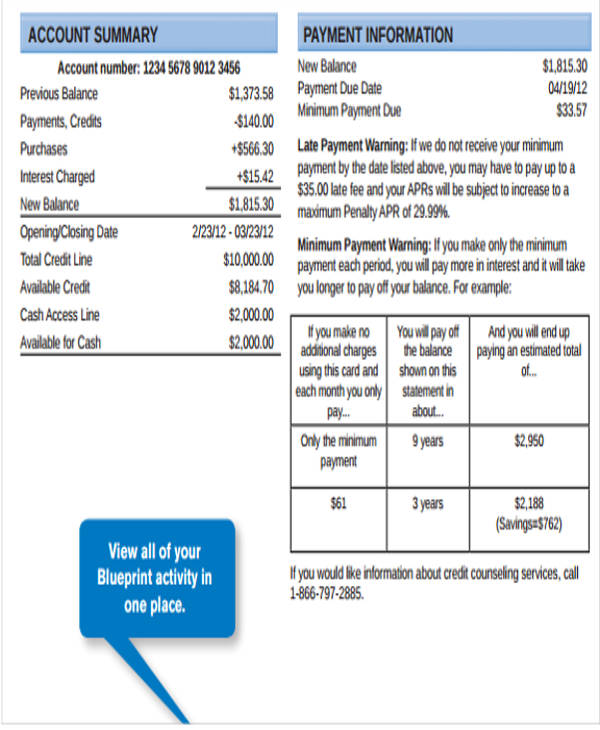

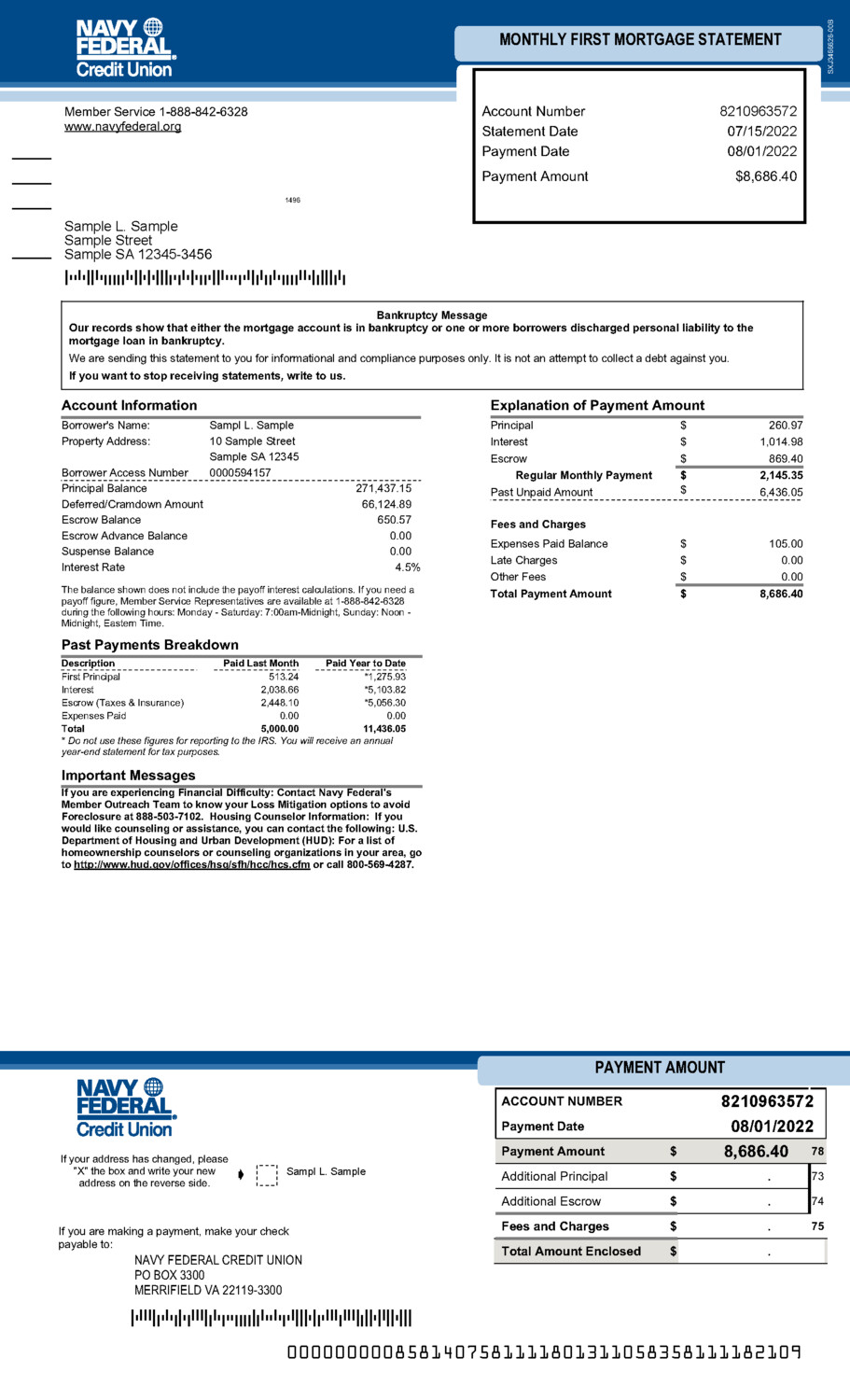

Key Components of a Chase Mortgage Loan Statement

Now that we’ve established the importance of your Chase mortgage loan statement, let’s take a closer look at its key components. Understanding these elements will empower you to make smarter financial decisions.

1. Payment Details

Your payment details are the first thing you’ll see on your statement. This section breaks down your monthly payment into principal, interest, and escrow components. It’s like a pie chart showing exactly where your money is allocated.

2. Outstanding Balance

This is the total amount you still owe on your mortgage. It’s important to monitor this figure over time to ensure it’s decreasing as expected. If you notice any irregularities, it might be time to reach out to Chase for clarification.

3. Interest Rate

The interest rate on your Chase mortgage loan statement can fluctuate depending on market conditions. It’s crucial to keep an eye on this rate, especially if you’re considering refinancing your loan.

4. Escrow Account

Your escrow account is used to pay property taxes and insurance premiums. The statement will show how much is being collected each month and the current balance in your escrow account.

How to Access Your Chase Mortgage Loan Statement

Accessing your Chase mortgage loan statement has never been easier, thanks to modern technology. You can receive your statement via email or access it online through Chase’s secure portal. Here’s how you can do it:

1. Online Access

Log in to your Chase account and navigate to the mortgage section. From there, you can view and download your statement anytime you need it. It’s quick, convenient, and secure.

2. Email Delivery

If you prefer receiving your statement via email, you can set up this option in your account settings. This way, you’ll always have a digital copy at your fingertips.

Common Mistakes to Avoid When Reviewing Your Chase Mortgage Loan Statement

Even the most diligent homeowners can make mistakes when reviewing their Chase mortgage loan statements. Here are a few common pitfalls to watch out for:

- Ignoring Escrow Adjustments: Escrow accounts can fluctuate due to changes in property taxes or insurance premiums. Make sure you’re prepared for these adjustments.

- Overlooking Extra Payments: If you’ve made additional payments toward your principal, ensure they’re reflected accurately on your statement.

- Missing Payment Due Dates: Pay attention to the due dates listed on your statement to avoid late fees and penalties.

Tips for Maximizing Your Chase Mortgage Loan Statement

Now that you know what to look for in your Chase mortgage loan statement, here are some tips to help you get the most out of it:

1. Track Your Progress

Keep a record of your statements over time to track your progress in paying off your mortgage. This will give you a sense of accomplishment and motivate you to stay on track.

2. Set Financial Goals

Use your statement as a tool to set realistic financial goals. Whether it’s paying off your mortgage early or reducing your monthly payments, your statement can help you chart a path to success.

3. Stay Informed

Stay informed about changes in interest rates and market conditions that could affect your mortgage. Knowledge is power, and being proactive can save you money in the long run.

Understanding Mortgage Terms on Your Chase Mortgage Loan Statement

Let’s face it, mortgage statements can be filled with jargon that might leave you scratching your head. Here’s a quick breakdown of some common terms you might encounter:

1. Principal

This is the original amount of money you borrowed to purchase your home. Over time, your payments will gradually reduce this balance.

2. Interest

Interest is the cost of borrowing money. It’s calculated as a percentage of your outstanding balance and is typically the largest component of your monthly payment.

3. Escrow

As mentioned earlier, escrow is a separate account used to pay property taxes and insurance premiums. It’s like a safety net to ensure these expenses are covered.

How Chase Mortgage Loan Statements Compare to Other Lenders

While Chase is known for its user-friendly mortgage statements, it’s always good to compare them to what other lenders offer. Here’s how Chase stacks up:

- Clarity: Chase statements are straightforward and easy to understand.

- Accessibility: With online and email access, Chase makes it convenient to stay on top of your finances.

- Customer Support: Chase offers excellent customer support to help you navigate any issues with your statement.

Real-Life Examples of Chase Mortgage Loan Statements

To give you a better idea of what to expect, here are a couple of real-life examples of Chase mortgage loan statements:

Example 1: John Doe

John Doe recently purchased his first home and is now receiving his Chase mortgage loan statements. By carefully reviewing each statement, John has been able to identify areas where he can save money and make extra payments toward his principal.

Example 2: Jane Smith

Jane Smith, a longtime homeowner, uses her Chase mortgage loan statements to monitor her escrow account and plan for future expenses. Her diligence has helped her avoid surprises and keep her finances in check.

Final Thoughts: Take Control of Your Mortgage

Understanding your Chase mortgage loan statement is an essential step in taking control of your financial future. By staying informed and proactive, you can make smarter decisions and achieve your homeownership goals.

So, what are you waiting for? Start reviewing your statements today and take the first step toward financial freedom. And don’t forget to share this guide with your friends and family who might find it helpful too!

Remember, knowledge is power. The more you know about your Chase mortgage loan statement, the better equipped you’ll be to manage your finances and make the most of your homeownership journey.

Table of Contents

- What Exactly is a Chase Mortgage Loan Statement?

- Why is Understanding Your Chase Mortgage Loan Statement Important?

- Key Components of a Chase Mortgage Loan Statement

- How to Access Your Chase Mortgage Loan Statement

- Common Mistakes to Avoid When Reviewing Your Chase Mortgage Loan Statement

- Tips for Maximizing Your Chase Mortgage Loan Statement

- Understanding Mortgage Terms on Your Chase Mortgage Loan Statement

- How Chase Mortgage Loan Statements Compare to Other Lenders

- Real-Life Examples of Chase Mortgage Loan Statements

- Final Thoughts: Take Control of Your Mortgage

Detail Author:

- Name : Prof. Kristin Bechtelar

- Username : dkoss

- Email : wbednar@hotmail.com

- Birthdate : 1992-02-06

- Address : 75760 Johns Lakes East Ron, MT 80714

- Phone : 502.989.0524

- Company : Schamberger LLC

- Job : Stationary Engineer OR Boiler Operator

- Bio : Ipsam nemo est numquam itaque. Inventore et molestias odit et ut nihil sed. Suscipit autem voluptatem suscipit impedit fugiat. Nisi quis aut sit deleniti at mollitia.

Socials

instagram:

- url : https://instagram.com/jkub

- username : jkub

- bio : Aliquam vitae sit quia velit cumque nam. Et quo maiores corrupti qui nam accusantium aut.

- followers : 6996

- following : 2694

twitter:

- url : https://twitter.com/jaleelkub

- username : jaleelkub

- bio : Ut magnam sit non. Temporibus eum recusandae soluta a quia ut.

- followers : 2024

- following : 2815

linkedin:

- url : https://linkedin.com/in/kub1984

- username : kub1984

- bio : Vero eveniet est magnam in recusandae hic.

- followers : 6059

- following : 1327

tiktok:

- url : https://tiktok.com/@jaleelkub

- username : jaleelkub

- bio : Necessitatibus non ullam fugit explicabo quos nisi reprehenderit voluptatem.

- followers : 4591

- following : 653